This is the type of simple yet profound question that often draws a quick answer, a nervous laugh, or a knowing smile from executives when we ask it.

Quick answers are: “the Sales team”, or business units, or general management, or even “everyone is responsible for revenue”.

Yet none of these answers is completely satisfactory. Digital transformation, for example, has widened the scope of responsibilities for the revenue generation process to include Sales as well as Marketing and Service teams.

Taking an even broader perspective, attaining revenue goals sustainably over time, is a cross-functional effort (including the strategy team, operations, finance, and so on), but these broad inclusions mean we need to get granular in roles and responsibilities for each piece of the processes or we risk the dilemma of “if everyone is responsible, then no one is responsible”.

A nervous laugh in response to the question that opened this article might be as a result of real-world grappling with issues such as sales-marketing alignment or living through plateauing or declining business results without a clear “throat to choke” (a popular, but horrible expression, no?).

Product-centric and/or entrepreneurial firms often experience an impressive initial period of growth before being surprised by declining revenues as other competitors enter the market and customers perceive better overall value elsewhere. Buck passing and finger-pointing (and missed targets) are common in organizations without clear responsibilities and accountabilities around revenue generation.

Organizations do not exist in a vacuum. Changes needed as the result of the pandemic, for example, have caused organizations to deeply reflect on the robustness of their revenue planning process. Supply shortages and shocks as the result of the pandemic, even in B2B services as a result of employee turnover, have meant that what is often taken for granted, i.e. constant and fluid supply (chains) have popped up as critical challenges to firms meeting their revenue goals. A plan is critical, as is the ability to be flexible and responsive when things change.

We’re quietly confident that our former and current clients and you, after reading this article, will be able to give a knowing smile and a coherent answer to the question of who is responsible for revenue and be able to continue to play your part in growing your organization, its people and its customers.

In this article, co-authored by Eve Chen, Ljubica Radoicic, and Brett Cowell, we briefly outline an approach and tools called the Revenue Generation Value Chain that can be used to analyze and transform revenue-generating processes to support growth in organizations. While we’re all experienced (and thus humble) enough to know that no model is a panacea or silver bullet for revenue generation (or any problem for that matter). At the same time, we’ve seen that a model can help get people literally on the same page and be a step towards the real secret sauce of change (and what each of us is passionate about) which is getting people aligned and working together to achieve results.

Since two of us, Eve and Ljubica, are seasoned B2B marketing professionals (Brett is a management and creative consultant) the focus of this article will be the same as the premise of our upcoming book, Ascending. The premise is that Marketing and Marketing leadership can and should play a key role in transforming the organization towards growth-centricity. And that the resulting transformation will necessarily be cross-functional and focused on revenue.

Why revenue?

We’ve experienced again and again the proclivity, if not the proficiency, of organizations to cut costs in order to hit short-term results. The problem with broad-based cost-cutting is that it can often stymie growth. Eve and Ljubica have experienced how marketing is often the first area to be cut back when short-term numbers are in jeopardy. Yet, we know the truism that you “can’t cut your way to growth”. Even private equity firms, having a reputation for cost-cutting, recognize that some of the cut costs must be reinvested into Sales and Marketing for a firm to grow.

It is nice to ask and answer smart questions about revenue, it is even better to have the benefits of sustainable revenue and growth in the bank.

Thus, rather than remain in a reactive mode around revenue and growth discussions, we’ve developed a model and body of experience around what we call the Revenue Generation Value Chain.

Revenue Generation Value Chain (RVC)

Michael Porter’s original value chain material e.g. Competitive Advantage (1985) focused on how a firm’s activities contribute to creating customer value, which is then captured by the system of the firm as a margin.

We recognize, even as passionate as Ljubica and I are about marketing, that the way forward for marketing-led (i.e. customer and market-led) business transformation is not for marketing to talk more about marketing, but for marketing to talk more about business.

This, and the following factors have shaped our thinking on the model:

- the overall trend (and need) for marketing to operate in an increasingly commercial way, including taking accountability for business results and revenue;

- the necessarily cross-functional nature of revenue generation; and

- the practical need to know the “who, what, and where” to transform processes and behaviors in the real world to increase revenue.

We’ve built a model that not only works for revenue analysis but also to help build a roadmap for change, not only for Sales and Marketing but for the business as a whole.

Note: to allay any fears that the model ignores profitability, we’ve designed the model to be data-driven, and to allow multiple layers of analysis (including customer and product and channel profitability and Pareto analysis), what-if scenarios, performance improvement tracking, and so on. We’ve found however that the biggest impact of the model in the first iteration is to be laser-focused on revenue generation.

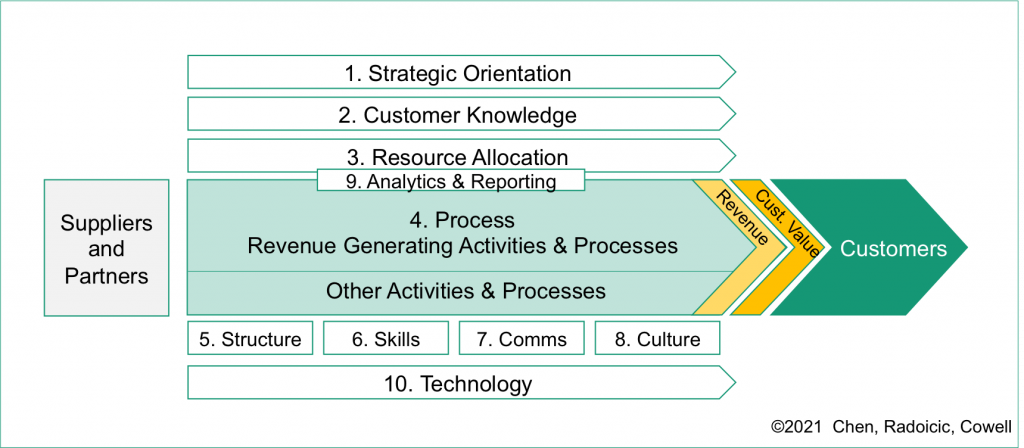

Here is the model:

Let’s quickly examine each component.

Before diving into the numbered dimensions, let’s first acknowledge that it is current (and future) customers that drive the model. The business “wins” by effectively monetizing the value created by addressing the needs and wants of customers. This might seem like a redundant statement, but particularly in the B2B space we still see a significant group of organizations where the majority of business activity is driven by product release schedules and quarterly numbers. You’d be forgiven for thinking that the customer is almost an afterthought.

A tendency towards short-termism is what we attempt to solve with the Strategic Orientation part of the model. Sustainable revenue performance is reliant on the firm taking a strategic perspective, that includes market and customer insights and using that perspective to guide decision making and resource allocation. Again it might seem trivial to note that firms should be strategic, except that many firms do not have a dedicated strategy or market insights team and/or they are not yet sold on the idea of strategy, being caught up in the seemingly endless issues and opportunities of the present moment.

Of course, there are potential mergers and acquisitions type considerations to be incorporated when thinking about long-term growth and strategy, so we’ll acknowledge that fact here, and defer a detailed discussion of that topic for another time.

If the organization seeks to be customer-driven then it must build and effectively use Customer Knowledge, and techniques such as segmentation, personas, and journey maps, not just in marketing, but to align all customer-facing functions, and finance, for example.

We’ve seen organizations that are not set up for success to reach revenue goals because Resource Allocation e.g. in terms of budgets and investment isn’t sufficient in some areas to support the required business activity, while the budget is excessive in other areas.

These first three areas (strategy, customer, and resources) might not seem top of mind when thinking about who is responsible for revenue. But if these areas are not managed effectively the organization is not set up for success, thus we call these three the “game plan”. If you fail to plan… well you know…

Leaders can be keen to hold others responsible, but perhaps revenue generation is not on track because of something they did or failed to do in the planning process… get a winning game plan.

Revenue Generating Processes

We find most illuminating in our work with organizations, the journey to understand and align around which key activities and processes generate revenue for the organization, to determine who is/should be responsible and how to measure the effectiveness of revenue generation at the detailed level.

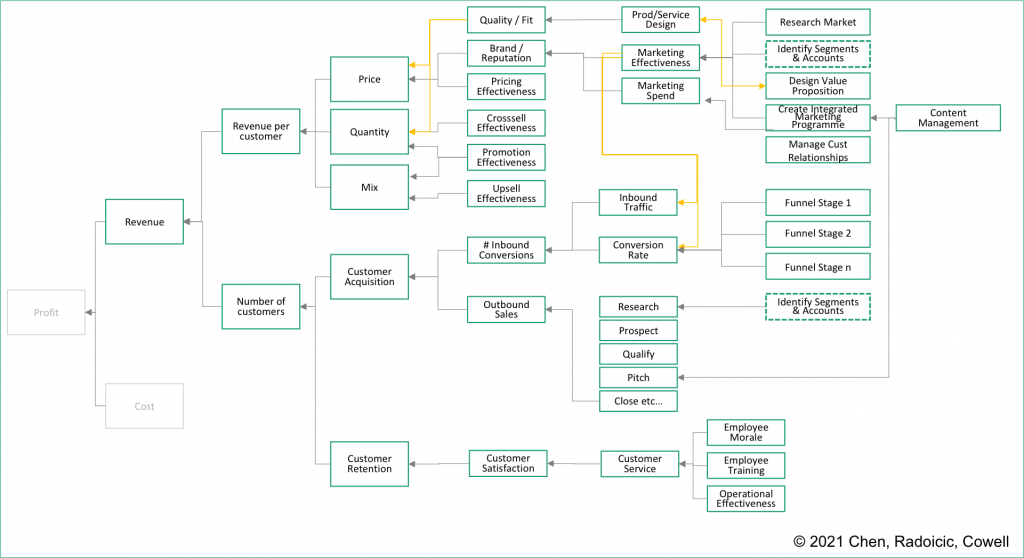

A structured way to approach analysis of revenue-generating activities is to build driver trees and use those to highlight processes directly connected to revenue generation that warrant further discussion.

Here is a high-level example of a revenue driver tree:

Even in large organizations, it is rare to find a complete set of up-to-date process maps (or driver trees) for the organization. It is more likely to find bits and pieces of process mapping associated with systems projects, or high-level maps associated with standards organizations, audits, and certifications, for example.

Also, revenue generation cuts across functional silos, unless the organization understands this and has done the work to map this out discussions on what drives revenue can be anecdotal rather than forensic.

The driver tree above is necessarily incomplete and high level, but we hope that it provides food for thought around which activities drive revenue.

Digging deeper into revenue generation

The Customer Acquisition process is a good place to start analyzing revenue-generating processes.

You can ask “what are the touchpoints with the organization for a new potential customer”? What does this look like from the potential customer’s point of view, and what does it look like from an organizational point of view (including all the customer-facing departments and functions)?

Many organizations who try to earnestly answer the questions above for the first time, involving a cross-section of the organization in the fact-finding process, quickly see disjoints, duplication, and misalignments in how business activity around Customer Acquisition connects to banked revenue. For example, in the value driver tree, you see that there are two separate processes called Identify Segments and Accounts, one for Sales and one for Marketing. Do those processes “talk” and align or not, and what is the implication of that.

At this point, it would be fair to feel less sure about the question of “who is responsible for revenue?” that you might have initially.

Your organization might reach the stage where they need a structured investigation into the revenue generation process. That project will attempt to map out the associated processes of Customer Acquisition (e.g. content management, sales calls,) and the associated roles and responsibilities for those. It will look at the upstream activities for Customer Acquisition such as Campaign Development and Execution, and Branding, and Product and Service Development, and Portfolio Management, and so on. In the book Ascending and in a future article we’ll share more detail on the list of revenue-driving processes and associated driver trees.

People

Once you have a better idea of the types of key activities associated with revenue generation, you can use the four people-related areas in the model to begin to look at how people support the planning and execution of those activities in terms of: Structure, Skills, Communication, and Culture. There are four buckets in the model rather than a single “people” bucket because we’ve found that four lenses provide a complete picture and a practical orientation towards specific initiatives that can be executed to better align people with revenue generation.

The next part of the model deals with Analytics and Reporting. This covers both the KPIs and accountabilities associated with revenue generation. Looking at KPIs “in the cold light of day” with regard to revenue generation can be a sobering experience. Often it is not clear how the KPIs directly relate to business value or revenue. Vanity metrics are common, and there are critical gaps in measures linking revenue generation activities with actual revenue.

The final aspect of the model is Technology. Often we see an organization buy a piece of technology to “fix” revenue generation without considering the other nine numbered components of the model. This often results in disappointment, frustration, and missed benefits on the part of the organization. We see technology as supporting the strategy, people, and process rather than being a substitute for those things.

Wrap

Revenue is more than a number, it is the result of an ongoing value chain of activities and processes, executed cross-functionally across the organization. We think that “who is responsible for revenue” might probably be best answered with the aid of a picture, and after undertaking a systematic process to understand and improve the core revenue-generating processes in the organization.

You might be asking yourself “what does good look like?” or “what are leading practices?” for each dimension in the model, and overall. For that we’ve developed an accompanying Demand Generation Maturity Framework, which outlines the characteristics of Crawl, Walk, Run and Leap organizations. We’ll discuss the maturity framework in a future article.

What action can you take right now?

Whether you’re an executive or a marketing professional, the first step is to get familiar with the model and with taking a holistic view of revenue generation across the organization. Why not try a brainstorming exercise to look at the Customer Acquisition process for your organization as we have in this article? Or contact Eve at info@growthengine.global if you would like a 15-minute complimentary discussion about how this tool can help transform your organization.